Risk Management in Investing:

How to Protect Capital While Growing Wealth in 2025 Investing is often associated with returns, performance, and growth. However, behind every successful portfolio lies a disciplined approach to risk. In today’s unpredictable financial environment, risk management in investing has become just as important as return generation. Market volatility, geopolitical uncertainty, interest rate shifts, and technological […]

Long-Term Investing Strategies in 2025:

Building Wealth in a Volatile Market Financial markets in recent years have been marked by volatility, uncertainty, and rapid change. Inflation cycles, interest rate adjustments, geopolitical tensions, and technological disruption have reshaped the investment landscape. As a result, long-term investing strategies in 2025 are more important than ever for investors seeking sustainable wealth growth. Rather […]

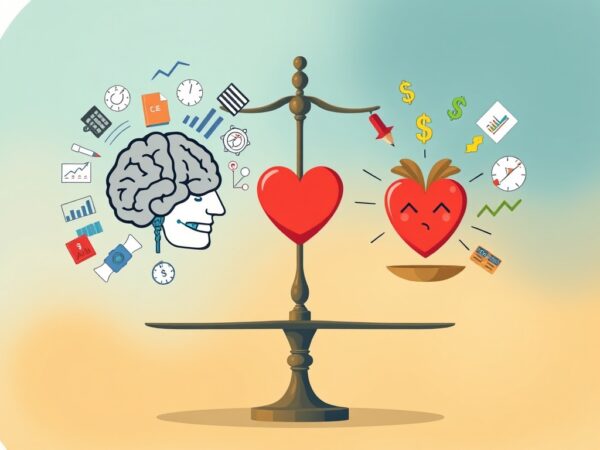

Behavioral Finance:

Understanding the Psychology Behind Investment Decisions In the world of investing, success is often thought to depend on logic, analysis, and data. Yet, even the most rational investors sometimes make decisions driven by fear, greed, or overconfidence. This is where behavioral finance investment psychology comes into play — an area of study that explores how […]

The Role of Diversification in Modern Portfolio Management

In the ever-evolving landscape of investing, few principles remain as timeless and essential as diversification. Whether you’re a new investor or a seasoned financial professional, understanding the role of diversification in portfolio management is crucial for achieving consistent and sustainable returns. Diversification is not merely about holding multiple assets; it’s a sophisticated strategy designed to […]

AI-Driven Investing:

How Artificial Intelligence Is Shaping Portfolio Strategies In 2025, the investment world is no longer just about human intuition or Wall Street expertise — it’s about algorithms, automation, and artificial intelligence. The rise of AI-driven investing has completely transformed how portfolios are built, optimized, and managed. With machine learning, predictive analytics, and natural language processing, […]

Behavioral Investing: Turning Biases into Opportunities

Investing has always been considered a numbers game — a world ruled by charts, trends, and cold analysis. Yet, beneath the surface of every market decision lies something far more human: emotion. Behavioral investing is the study of how psychological influences and biases affect investors’ choices and market outcomes. By understanding these tendencies, investors can […]

The Psychology of Investing:

How Emotions Impact Financial Decisions Investing is often described as a rational process based on data, analysis, and logic. Yet, when we look at real-world behavior, it becomes clear that human psychology plays a crucial role in shaping financial decisions. The psychology of investing is what often separates successful investors from those who make costly […]

Investing in Artificial Intelligence Companies

Investing in artificial intelligence companies has become one of the most powerful financial strategies in the modern economy. Artificial intelligence (AI) is not just a technological innovation—it represents a global shift in how businesses create value, optimize performance, and engage with customers. From personalized healthcare to self-driving cars, AI is transforming industries at an unprecedented […]

How to Build a Diversified Portfolio

Diversification is one of the most fundamental principles of successful investing. It helps reduce risk, smooth out volatility, and enhance long-term returns by spreading investments across different asset classes, sectors, and geographic regions. In today’s dynamic financial landscape, understanding how to build a diversified portfolio is more critical than ever. This article explores what diversification […]

Real Estate Investing in the Digital Age

The world of real estate investing is undergoing a profound transformation. Once considered one of the most traditional asset classes, property investment is now embracing cutting-edge technology that is revolutionizing how investors buy, sell, and manage real estate. From blockchain-based tokenization to AI-driven analytics, the digital age has opened the doors to accessibility, transparency, and […]